Saturday, August 30, 2014

$FDX closed below its 50-day moving average

FedEx is in the news for all of the wrong reasons. I still rate the company as a long-term buy.

$RVX vs. $VIX illustrates why small stocks are being spurned

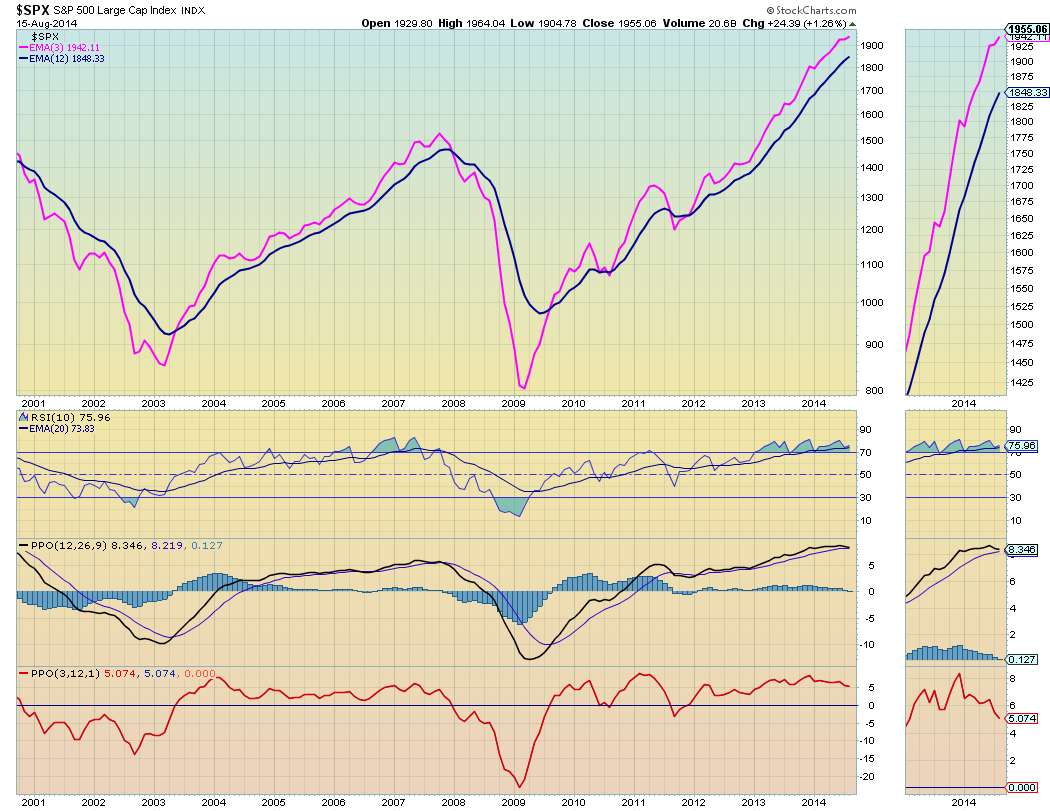

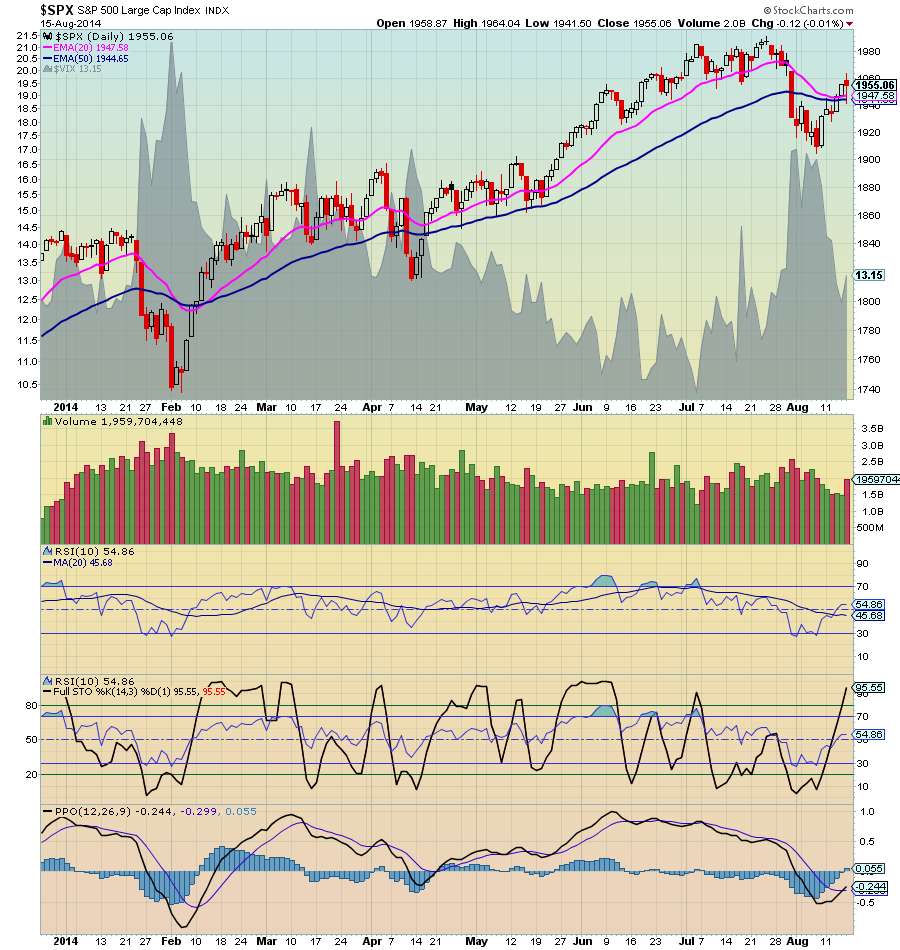

The volatility risk/reward favors large stocks given year-to-date performance of the S&P 500 vs. the Russell 2000. S&P 500 is up 8.4% vs. 0.9% for Russell year-to-date.

Friday, August 29, 2014

Sunday, August 24, 2014

Saturday, August 23, 2014

Monday, August 18, 2014

Sunday, August 17, 2014

$UPS has lagged the S&P 500 and $FDX

Let's see if $UPS gains given that $FDX is in the news for not good reasons.

$FDX may trade sideways for a while

The market will figure out that $FDX charges for drug dealing are completely bogus.

Saturday, August 16, 2014

Friday, August 15, 2014

Saturday, August 9, 2014

Weekly performance of major Index ETFs

All show gains for the week after experiencing losses last week.

Saturday, August 2, 2014

When everyone is selling, buy!

Don't be afraid of stock market corrections. History has proven that buying when everyone is selling has its rewards.

Stock:Bond ratio's recent trend favors bonds, but the reason may not be what you think

The ratio shows a downward trend starting in July. Bonds have not declined as much as stocks recently which is why the trend is downward. This is why bonds belong in very portfolio since they are less volatile than stocks and buffers the portfolio when the inherent volatility in stocks, the ups and downs, shows in performance.

Friday, August 1, 2014

Subscribe to:

Posts (Atom)