Sunday, September 28, 2014

Sunday, September 21, 2014

A rising U.S. dollar ($USD) favors stocks over commodities ($CRB)

Commodities are negatively correlated to the U.S. Dollar

Saturday, September 13, 2014

Facebook - $FB shows resistance at $78

The stock just seems to be pausing, but the long-term trend is bullish.

$SPY - The pullback in the market looks like a buying opportunity

Scale in until you reach your investment target.

Wednesday, September 10, 2014

Saturday, September 6, 2014

Monday, September 1, 2014

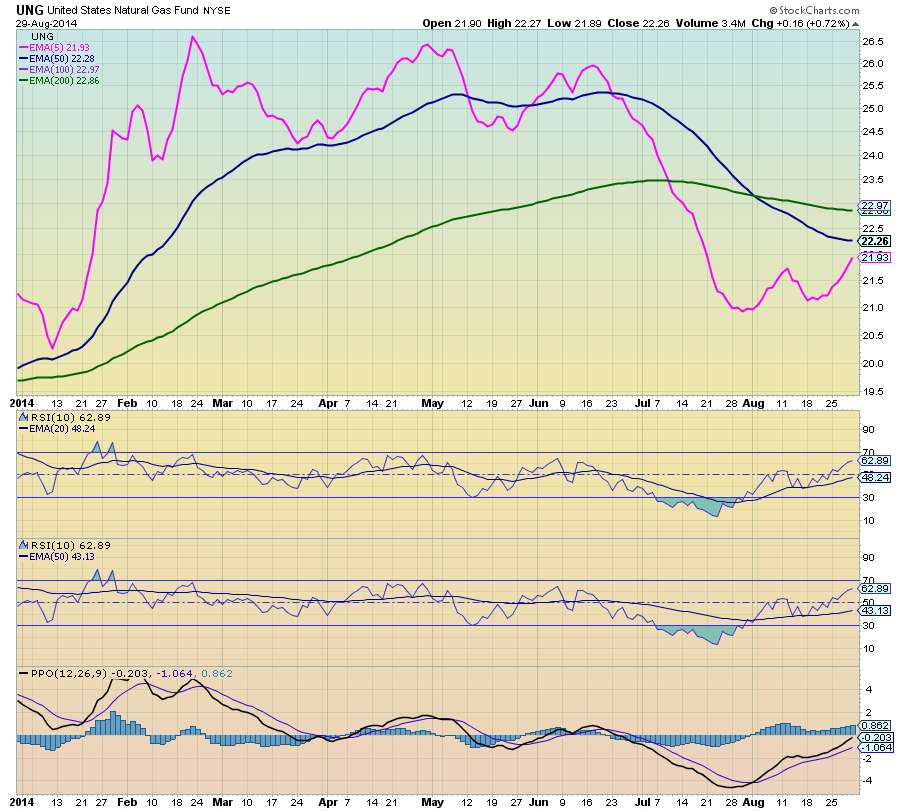

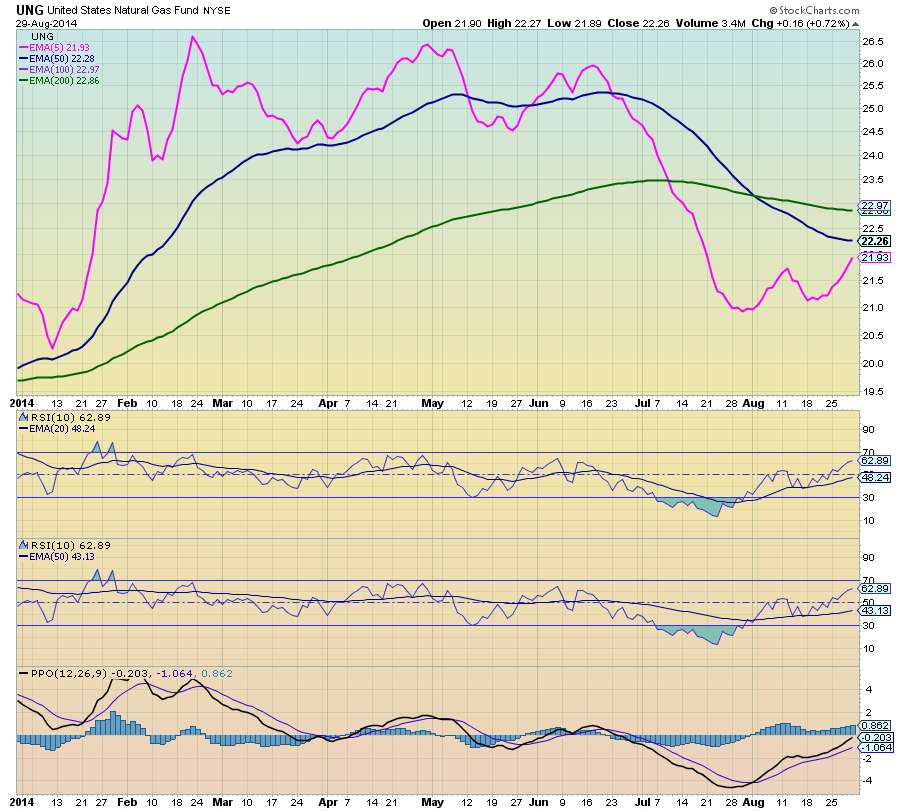

$UNG - Higher natural gas prices may be a good bet

Buy now and hold until March 2015. Keep your fingers crossed.

Subscribe to:

Posts (Atom)