Daily Chart

- Bullish trend since mid-July

- An exit above the cloud will turn the chart more bullish

Weekly Chart

- Price closes slightly above the cloud which is bullish

- If you missed shorting it on Friday, don't worry there may be another chance.

- Traders may now have a potential buying opportunity for a quick, but limited profit. Wait for your signal.

- YTD performance confirms that the market is bullish, but market uncertainty has tempered overall returns

YTD 1-YEAR

Performance Performance

$DIA -0.16% +5.22%

$SPY +2.14% +6.77%

$IWM +2.38% +7.52%

$QQQ +8.10% +15.62%

$BND +0.16% +2.17%

Year-To-Date Performance

1-Year Performance

Weekly Chart

- Weekly chart remains bullish

- A close below Kijun Sen (red line) would be troublesome

- Watch closely due to bearish engulfing candlestick

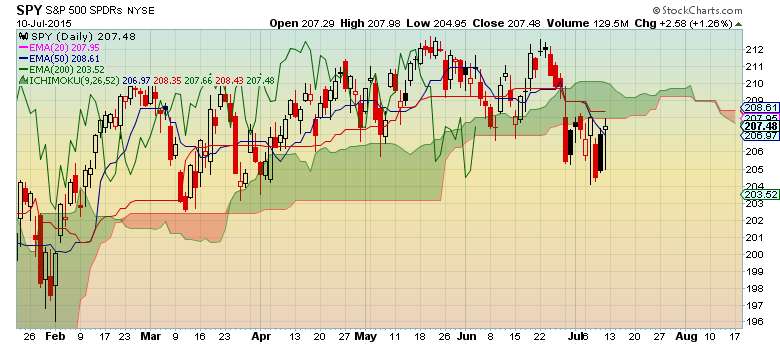

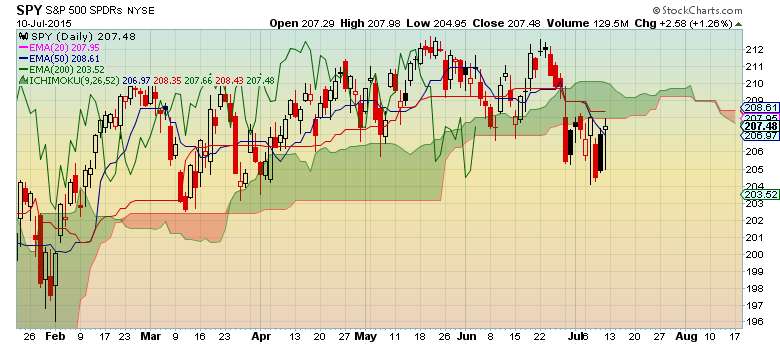

Daily Chart

- Bearish tilt since price closed below the cloud

- Not completely bearish due to other cloud elements

- Chikou Span closing below the cloud can be used as confirmation and it is currently above the cloud

- Initial support around $203-$204 if market breaks down

Hourly Chart

- Bearish trend

- Chikou Span, Tenkan Sen, and Kijun Sen have not fallen below cloud yet which will completely turn the chart bearish

- Traded higher on Friday, but has not broken out of $110-$114 trading range

- Tenkan Sen (blue line) needs to start pointing upward for upward momentum

- Future Kumo is bullish, but still flat although Senkou Span A is tilting upward which is promising

- Sentiment: Bearish

- % Below 200-EMA: -16.9%

- % increase needed to reach $50: 43%

- Probability of being below $50 over the next 50-days: 93%

Weekly Chart

- Sentiment: Bullish

- Kijun Sen is acting like support which is around $204

Daily Chart

- Sentiment: Bearish since price is below Kumo.

- Current Kumo is bullish while future Kumo is bearish

- Price seems to be finding support in the $204-$205 range

- A breakout above the cloud will confirm that the pullback has reversed

Hourly Chart

- Kumo breakout looming which is bullish

- Future Kumo has turned bullish

- A breakout above the cloud should carry over to daily chart to complete the reversal of the pullback

- Short-term trend is bearish

- Intermediate and long-term trends are still bullish

- Monitor market for bounce off support to improve risk/reward ratio

- A close below the support zone will turn intermediate term bearish

- A move into the cloud would show some upward momentum

- $SPY needs to move back above the cloud to turn bullish

- A close toward $203 would threaten the 200-day EMA

Daily Chart

Daily Chart Hourly Chart

Hourly Chart